After taking a short break, we’re catching you up on two weeks of real estate news. With so much to cover, we’ve broken it up into themes.

I: Higher rates put transaction volumes under pressure

Average 30-year mortgage rates rose more than 50 basis points in April (0.5% = half a percentage point), and briefly exceeded 7.5%. [Mortgage News Daily]

The NAR’s Pending Sales Index for April 2024 fell 7.7% month-over-month and 7.4% year-over-year to 72.3 (blue line in the graph below). That’s the lowest index level in several years, and suggests that the May 2024 existing home sales could dip below 4 million units (SAAR) again. [NAR]

MBS Highway’s National Housing Index dropped for the second straight month in June, with the Buyer Activity sub-index dropping 6 points to 45. Anything below 50 signals a contraction in transaction volume. The Northeast was the strongest region; the Southeast, the weakest. [MBS Highway]

II: Home price growth stayed strong, but not everywhere

On a nationwide basis, home prices continue to rise. But it’s important to remember that nobody buys a home for the national median home price! There is considerable regional variation.

Case-Shiller’s national home price index rose 0.3% month-over-month in March and is now up 6.5% year-over-year. That said, 5 of the big city indexes declined MoM in March (Dallas, Denver, Phoenix, Seattle and Tampa). [S&P Global]

CoreLogic’s HPI rose an impressive 1.1% month-over-month in April, after similar growth in March. On their numbers, home prices are up 5.3% year-over-year. [CoreLogic]

III: Job growth seems to be slowing, but the BLS report didn’t show that

We started jobs week with the JOLTS report for April, which saw the total number of job openings drop 5% month-over-month to 8.1 million. While that’s still a big number, it’s 18% below April 2023 and 31% below April 2022.

ADP’s monthly employment report showed that just 152,000 new private sector jobs were added in April. That was both well below expectations (of around 175,000) and the smallest job gains seen since January.

But then the all-important BLS jobs report for April came out, and it sent mixed signals. First, that the economy added a higher than expected 272,000 jobs. Second, that the unemployment rate inched up to 4.0%.

IV: CPI for May came in lower (better) than expected

The “headline” CPI (Consumer Price Index) was flat month-over-month in May. The “core” CPI grew only 0.2% MoM. Expectations were for +0.1% on the headline and +0.3% for the core. As a result, the year-over-year “core” figure fell from +3.6% in April to +3.4% in May, and the YoY “headline” figure dropped from +3.4% in April to +3.3% in May.

V: The rate cuts are coming!? [that’s a Paul Revere pun]

The ECB (European Central Bank) cut interest rates for the first time in five years, from 4.00% → 3.75%. But it did not commit to further cuts, warning that “domestic price pressures remain strong.”

The Bank of Canada also cut rates, from 5.00% → 4.75%, with BoC Governor Tiff Macklem saying that it’s “reasonable to expect further cuts” if inflation continues to moderate.

Always marching to its own data-dependent drum, the US Federal Reserve voted (once again) to do nothing, keeping its short-term policy range at 525–550 bps (5.25%-5.50%). The updated “dot plot” of Fed member forecasts for the Fed Funds Rate now calls for 1–2 rate cuts before year end 2024, and 100 basis points of cuts in each of 2025 and 2026.

The State of Inventory

In May 2024, the number of nationwide active listings (inventory) climbed to 788,000 — up 35% year-over-year and the highest figure since July 2020. While that is certainly good news, it’s important to maintain perspective: 1) active listings are still DOWN 33% from pre-pandemic levels, and 2) most of the recent inventory gains are coming from a few states (chiefly Florida and Texas).

As the map below illustrates, more than half of the states had inventory levels in May 2024 that were more than 40% below pre-pandemic [shades of blue], and 9 had inventory levels that were more than 60% below pre-pandemic. Spare a thought for would-be buyers and real estate agents in Connecticut, where inventory is nearly 80% lower than it was in May 2019!

Nearly one-third of the active listings in May 2024 came from two states: Florida (18%) and Texas (13%). Texas’ active inventory is now 2% ABOVE where it was in May 2019, and Florida’s active inventory is ONLY 4% below. Not surprisingly, it is in the ‘green states’ below that we are seeing the greatest pricing pressure in certain cities.

You Know What They Say About Assumptions

I’ve had three friends in the last few weeks ask me about assumable mortgages. The enticing idea is that a buyer could simply ‘take over’ the seller’s existing loan and therefore benefit from a much lower mortgage rate than they could obtain themselves in the current market.

The most important thing you need to understand is that most mortgages don’t work like this. Think about it: the seller’s mortgage rate reflects HIS credit worthiness, the price of the home, and the interest rate conditions prevailing at the time of their purchase (perhaps many years ago). Why on earth would a bank just give you that loan?

The answer is that they won’t. First, the new buyer must qualify for the existing loan. Second, if the value of the home has gone up since the original purchase (and it probably has), the new buyer needs to come up with the difference, either through additional equity or another mortgage at a higher (market) rate. Third, there is a lot of paperwork involved — this could add weeks to the closing process, which a seller might not be interested in.

Assumable loan facts

- Many government loans (FHA, VA etc.) are assumable with conditions.

- But even if the loan IS assumable, the seller (and the bank) still needs to be willing to accept this more complicated (and slower) option.

- Since 2019, ~8% of home loans originated in the US were VA loans and ~15% were FHA loans. That’s nearly one quarter of all mortgages! (Source: Realtor.com)

- However, only 0.4% of current active listings are advertised as offering an assumable mortgage (Source: Realtor.com) This low figure demonstrates the difficulties and disadvantages of the mortgage assumption process.

Conclusion: It would be incorrect to assume that assumable mortgages are easy to find and easy to do. That said, for people in areas with a higher % of assumable mortgages (perhaps around military bases etc.), the interest savings could be tremendous — assuming they can come up with the top-up payment, of course.

Got any assumable mortgage stories you’d be willing to share with me? Send me an email: scott@listreports.com.

Mortgage Market

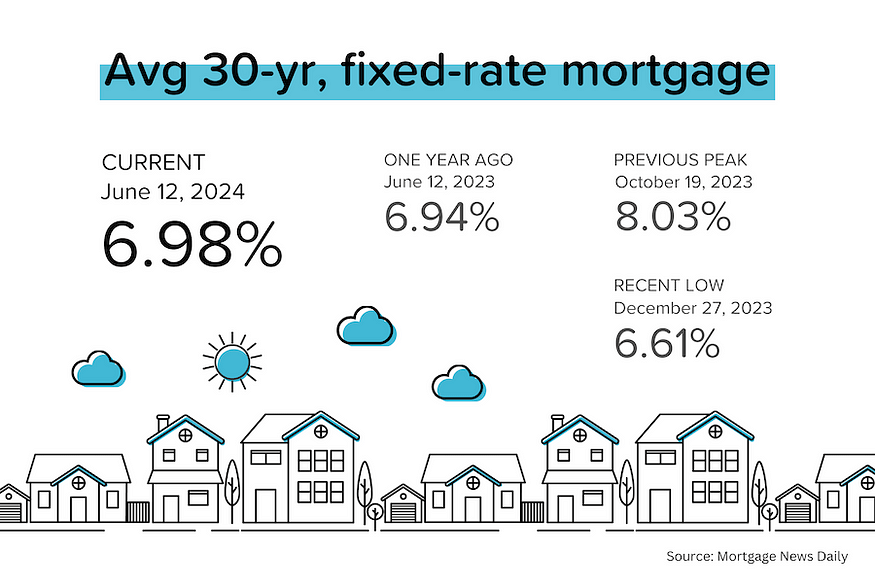

Mortgage rates have been very volatile over the last few weeks, whipsawing on positive (JOLTS + ADP) and then negative (BLS) jobs figures. Then Wednesday’s double-whammy of lower than expected CPI inflation data plus the Powell’s somewhat dovish press conference helped send average 30-yr mortgage rates back down to near 7.0%

Over the past few weeks, both the European Central Bank and the Bank of Canada cut rates. But while progress on US inflation came rapidly in late 2022/early 2023, it has been painfully slow since then. The “core” PCE was at 2.8% in April 2024, still well above the Fed’s 2% target. And the most recent BLS jobs data appeared to show a reacceleration in hiring.

Current odds on Fed rate cuts at upcoming FOMC meetings below. Keep in mind that the US Presidential election is on November 5.

- July 31: 9% (was 9% on 6/10)

- Sept 18: 63% (was 47% on 6/10)

- Nov 7: 77% (was 62% on 6/10)

They Said It

“The impact of escalating interest rates throughout April dampened home buying, even with more inventory in the market,” said NAR Chief Economist Lawrence Yun. “But the Federal Reserve’s anticipated rate cut later this year should lead to better conditions, with improved affordability and more supply.” — Lawrence Yun, NAR’s Chief Economist

“Consumer sentiment toward housing declined from its recent plateau, as an increasing share of consumers struggle to find the positives in the current housing market. While many respondents expressed optimism at the beginning of the year that mortgage rates would decline, that simply hasn’t happened, and current sentiment reflects pent-up frustration with the overall lack of purchase affordability.” — Doug Duncan, Fannie Mae’s Senior Vice President and Chief Economist

“Annual U.S. home price appreciation remained above 5% YoY in April, with three states posting double-digit gains. By next spring, national price gains are projected to slow to 3.4% YoY, with only a few states putting up increases of higher than 6%. This slow cooling reflects not only the increasing number of homes on the market in some parts of the country, but also elevated, 30-year, fixed-rate mortgages, which remain around 7%, a major factor influencing America’s continuing housing affordability challenges.” — CoreLogic’s April HPI report