The latest inflation readings keep the Fed on track for a rate cut in September, while home prices continue to appreciate nationwide. Here are the top stories:

- Consumer Inflation Continues to Moderate

- Home Prices Hit Another New High

- Pending Home Sales Soft … For Now

- Second Quarter GDP Revised Higher

- Jobless Claims Continue to Show Labor Sector Weakness

Consumer Inflation Continues to Moderate

July’s Personal Consumption Expenditures (PCE) showed that headline inflation rose 0.2% from June, while the year-over-year reading remained at 2.5%. Core PCE, the Fed’s preferred method which strips out volatile food and energy prices, also rose 0.2% monthly. The year-over-year reading held steady at 2.6%, remaining at the lowest level in three years.

What’s the bottom line? Inflation has been moderating and is heading toward the Fed’s 2% target as measured by Core PCE. The cooling consumer inflation we’ve seen in recent months combined with signs that the job market is slowing have led to growing calls for the Fed to begin cutting their benchmark Fed Funds Rate, which is the overnight borrowing rate for banks.

Fed Chair Jerome Powell recently confirmed that “the time has come for policy to adjust.” The latest PCE readings keep the Fed on track to cut rates at their next meeting on September 18.

Home Prices Hit Another New High

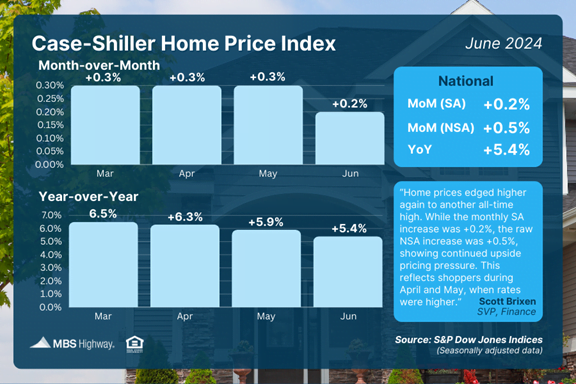

The Case-Shiller Home Price Index, which is considered the “gold standard” for appreciation, showed home prices nationwide rose 0.2% from May to June after seasonal adjustment, breaking the previous month’s all-time high. Home values in June were also 5.4% higher than a year earlier, following a 5.9% gain in May.

The Federal Housing Finance Agency’s (FHFA) House Price Index did report that home prices fell 0.1% from May to June, though they were 5.1% higher when compared to the same time last year. Note that FHFA’s data does not include cash buyers or jumbo loans, only loans financed with conforming mortgages. These factors account for some of the differences in the two reports.

What’s the bottom line? The reports from Case-Shiller, FHFA and other major home price indexes like CoreLogic and ICE show that homeownership continues to provide a significant wealth creation opportunity for people around the country.

Pending Home Sales Soft … For Now

Pending Home Sales plunged 5.5% from June to July, per the National Association of REALTORS® (NAR), coming in well below estimates of a flat reading. Sales were also 8.5% lower than they were a year earlier. This report measures signed contracts on existing homes, making it an important forward-looking indicator for closings on these homes as measured in the Existing Home Sales report.

What’s the bottom line? While signed contracts on existing homes were soft last month, that’s not the whole story. It takes time for the impact of lower rates to translate into buyers shopping, finding a home, negotiating, and eventually signing a contract. NAR’s Chief Economist, Lawrence Yun, confirmed that “current lower, falling mortgage rates will no doubt bring buyers into market,” which means the volume of signed contracts will likely rise in the months ahead.

Second Quarter GDP Revised Higher

The U.S. economy grew by 3% in the second quarter per the latest Gross Domestic Product report from the Bureau of Economic Analysis. This second reading of the data was above the initial 2.8% estimate and more than double the 1.4% growth seen in the first quarter of this year.

What’s the bottom line? Economic activity was better than expected last quarter due in part to increases in consumer spending, private inventory investment and business investment. Note that this data could be revised one more time when the final reading is released on September 26.

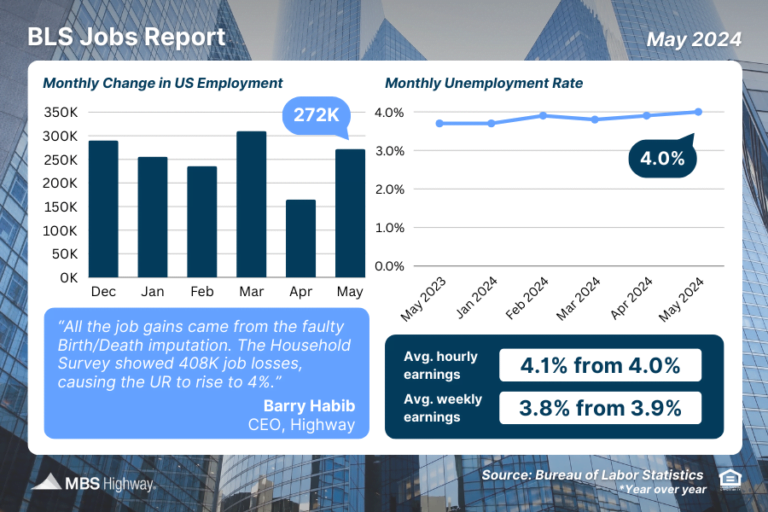

Jobless Claims Continue to Show Labor Sector Weakness

Initial Jobless Claims fell slightly in the latest week, with 231,000 people filing for unemployment benefits for the first time. Continuing Claims rose by 13,000, as 1.868 million people are still receiving benefits after filing their initial claim, meaning this metric remains near the highs from November 2021.

What’s the bottom line? Both Initial and Continuing Claims have trended higher this summer when compared to the beginning of the year, with Continuing Claims topping 1.8 million each week since the start of June. This shows that layoffs have risen while new job opportunities have also become scarcer.

Family Hack of the Week

September is National Honey Month, making now the perfect time to enjoy these Honey Cookies courtesy of Allrecipes. Yields 4 dozen cookies.

Preheat oven to 350 degrees Fahrenheit. Melt together 1 cup sugar, 1 cup butter, and 1 cup honey in a saucepan over low heat. Let cool. In a small bowl, mix 2 large eggs, 1 teaspoon vanilla, 1 teaspoon baking soda and 1 teaspoon ground ginger. Gradually add egg mixture to cooled honey mixture. Slowly add 4 cups all-purpose flour and stir until well blended.

Drop teaspoonfuls onto cookie sheets about 2 inches apart. Bake until golden, about 12 to 15 minutes.

What to Look for This Week

Crucial labor sector data will be reported, with updates on job openings Wednesday, private payrolls and unemployment claims Thursday, and nonfarm payrolls and the unemployment rate Friday.

We’ll also see more housing appreciation data from both CoreLogic and ICE.

Technical Picture

Mortgage Bonds ended last week just beneath support at 100.79, which will now act as a ceiling of resistance with the 25-day Moving Average now a floor of support. The 10-year ended the week in the upper bound of a wide range between support at 3.80% and overhead resistance at the 25-day Moving Average and 3.92% Fibonacci ceiling.